There are many types of Life insurance and each have their uses. Here’s a summary:

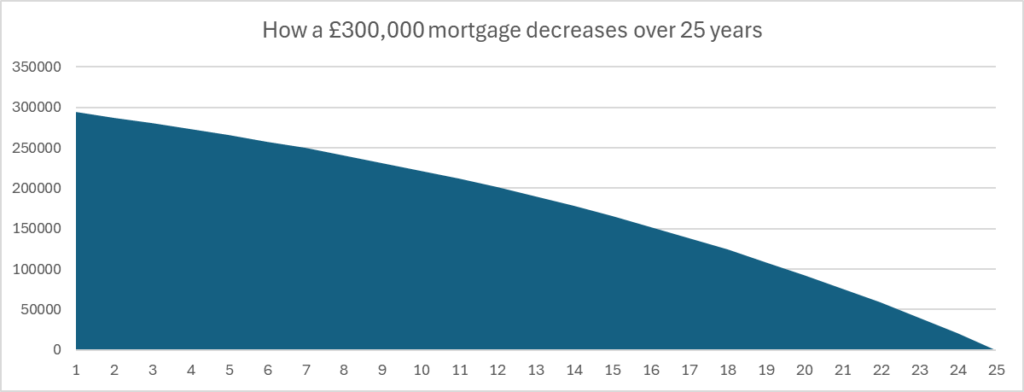

Decreasing Life cover

Often referred to as mortgage protection this is probably the most common type of Life cover. It does what it says on the tin. In the event of you passing away then a lump sum will be paid out which should be enough to pay off the mortgage in its entirety assuming that the original details of the cover were accurate. The cover is designed to decrease in-line with how a mortgage decreases. There is usually a caveat that the insurance will pay off the whole mortgage as long as interest rates do not go above a set figure usually 8%. The benefit of these plans is they are the most cost effective as the value decreases over time but if all you need is the mortgage cleared on death then this is the plan for you.

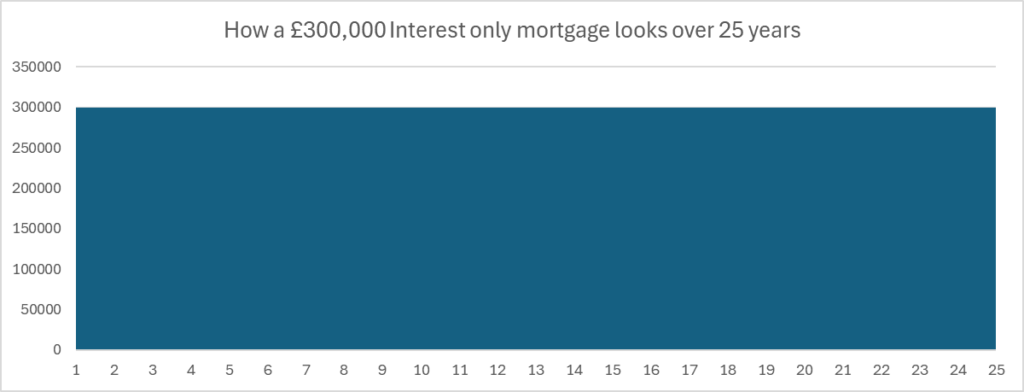

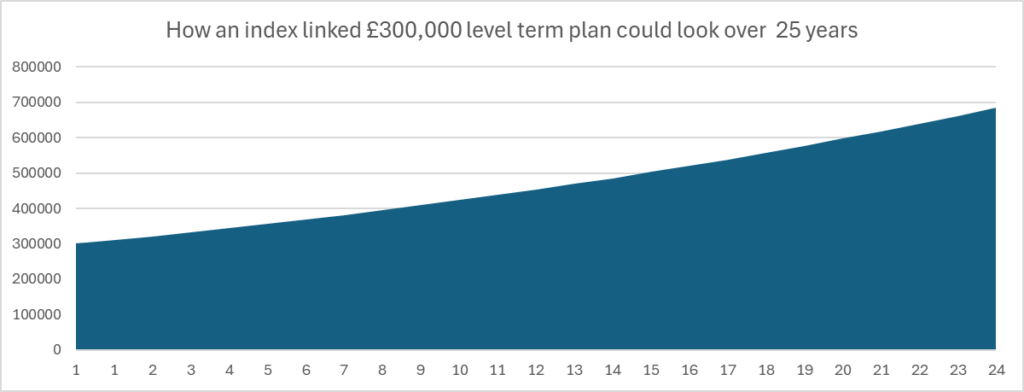

Level Term cover

Level Term cover or assurance is designed to help protect other things, the main one is usually family protection. Latest figures show that it costs around £250,000 to bring up just one child so you could simply have cover that grants your family £250,000 x the number of dependent children. Its is usually put in place for as long as they are dependent, this differs between families but can be 18 to 25 years old. It is also recommended to link the plan to an inflation index. Currently we have all experienced increases in the cost of living and this mitigates and loss of value of your policy over time. If you do index-link the plan then there is a small increase in the cost of the plan each year to compensate for the increase in sum assured. This policy can also be used for Interest only mortgages, loans, legacy payments. Its very flexible and your adviser will help you decide which plan is the most cost effective for you.

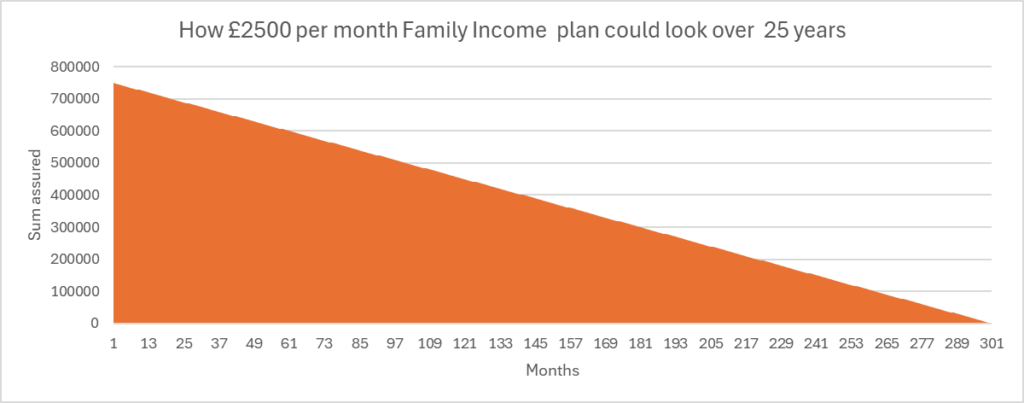

Family Income Benefit

Here is a hidden gem of a plan that many people are not aware of. Family income benefit is designed to specifically protect your family. These work really well alongside the decreasing mortgage protection plans if you have a mortgage and young family. Rather than estimating how much cover a family would need over time which you would need to do with a Level term plan. Family Income benefit will grant the family a specific monthly benefit which your advise will calculate based on answers during the fact find. This is usually based on the families outgoings minus the mortgage payment and any other monthly costs that would be reduced if a loved one died. If a parent died prematurely with 3 children than rather than using the calculation above (Eg 3 x £250,000) and setting in place £750,000 over Life cover, using Family Income Benefit you could take your monthly Bills of say £2500. This would still over 25 years provide £750,000 but because it is a stepped benefit it is much more cost effective. You can also index-link the plans as above.

Working Example

Lets show how money can be saved using the following example:

Bob is a 30 year old male non-smoker with 3 children(aged 3 months, 2 & 4). He has a £250,000 mortgage over 25 years with his Wife Betty who is also 30 and a non-smoker. Betty has had advice before and has got Life insurance for the mortgage and family. Betty & Bob have outgoings of £1500 each on top of the mortgage so Betty’s previous adviser calculated that Betty would need the mortgage paid upon death and £1500 per month to cover her share of the bills. £1500×12(months)x25 years (age when the youngest will be independent). This equals £250,000 + £450,000. Bettys previous adviser was a little lazy and just put in place a Level Term plan for £700,000 over 25 years at a cost of £24.96 per month.

Now Bob spoke to James, an experienced adviser, and using the same info, James recommended covering the clients same concerns using the decreasing mortgage protection and Family Income Benefit. James put in place £250,000 decreasing mortgage protection over 25 years and a Family Income benefit of £1500 per month over 25 years. Bob was astounded when the price came in at £15.01 per month, a saving of nearly 40%! As the cover covered their main concerns, Bob immediately asked James to include Betty in his quote and move her cover across to a similar plan.

*Prices accurate on day of writing 23/04/2024 using Royal London